Anyone who's worked in corporate tax knows the drill. Trial balance processing should be straightforward—you get spreadsheets with account numbers, descriptions, and year-end balances. Extract the data, move on with the next step in the process.

Except it's never that simple. Client A puts everything in neat columns. Client B jams account codes and descriptions together. Client C splits account numbers across three different cells. And that's before you deal with the real fun: random pagination headers scattered throughout the data, subtotal rows that look suspiciously like real entries, and files that somehow contain two completely different chart of accounts.

The result? What should take minutes becomes hours. Senior staff burn time on data entry. Even more expensive resources then spend additional hours reviewing every extraction, hunting for the inevitable mistakes that slip through manual processing.

This type of task is ideal for automation - it's low value work that nobody wants to do, but the complexities in the input data make it hard to achieve.

The Insight That Changed Everything

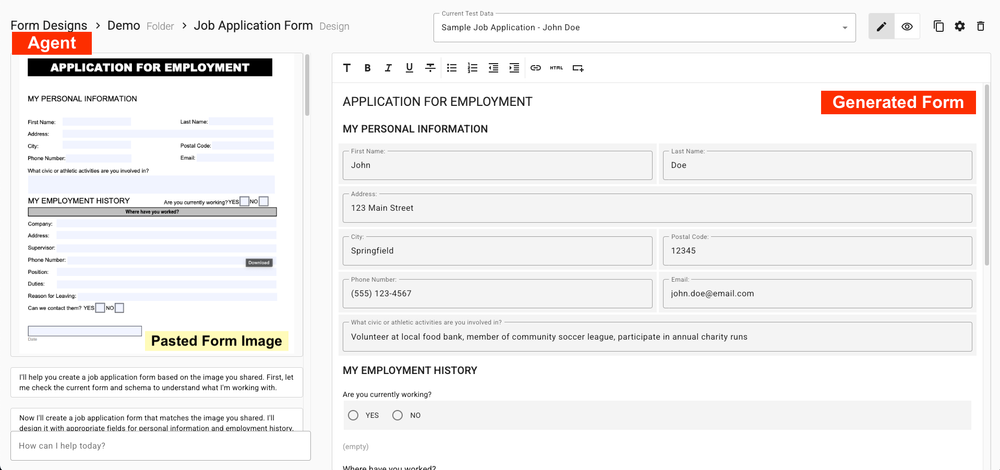

Most organizations would attack this with traditional automation—write rules, handle edge cases, hope for the best. Apex took a different approach, guided by an observation that emerged from building production AI systems over the past year:

When AI succeeds at complex tasks, it produces consistent results. When it fails, it fails differently every time.

This insight sparked a deceptively simple solution: run the extraction three times. If all three attempts produce identical results, proceed with confidence. If they differ, route to human review.

The Three-Run Pattern in Action

Why This Pattern Delivers Results:

- Built-in Confidence Scoring: System knows when it's reliable versus when it's guessing

- Selective Automation: Routine files process automatically while complex cases get expert attention

- Resource Optimization: Senior staff focus exclusively on challenging extractions

- Complete Audit Trails: Every decision point maintains compliance-ready documentation

Real-World Performance

The transformation wasn't just operational—it fundamentally changed how the consulting firm approaches trial balance processing. What was once a bottleneck became a competitive advantage. Files that previously required hours of careful manual work now process in minutes, with reliability that exceeds human-only approaches.

Strategic Implications

The applications extend far beyond tax preparation. Any process involving document variations, client-specific formats, or expert review workflows can benefit from consistency-based confidence scoring. Contract analysis, regulatory filings, financial statement preparation—wherever human expertise handles edge cases, this pattern applies.

The key realization: stop trying to make AI perfect. Make it predictably reliable, and architect human expertise into the feedback loop.

Ready to Build AI That Your Business Can Actually Depend On?

This consistency pattern is already transforming document processing for enterprise clients. Let’s discuss how it can solve your specific automation challenges.